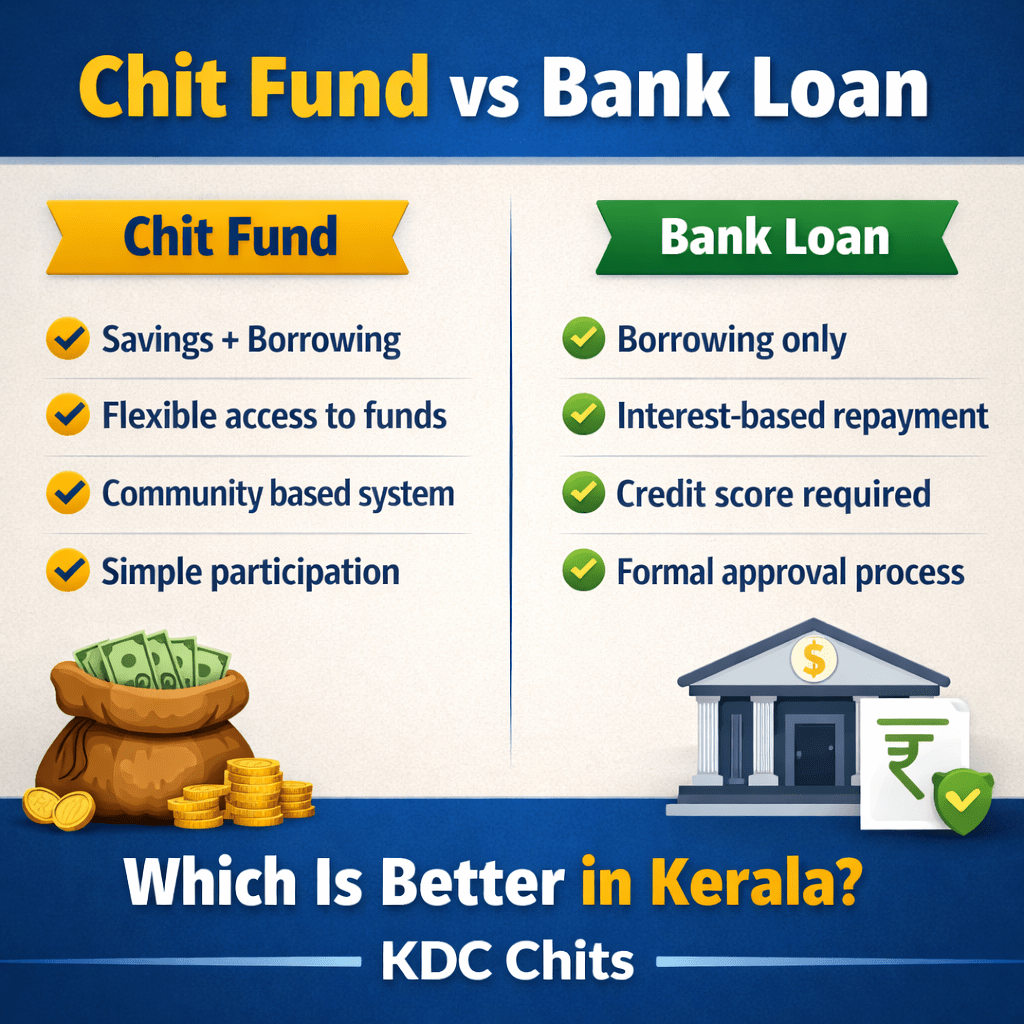

Chit Fund vs Bank Loan – Which Is Better in Kerala?

Managing finances often requires access to funds at the right time. In Kerala, two common options people consider are chit funds and bank loans. Both financial options serve different purposes and come with their own advantages. Understanding how they work can help individuals choose the most suitable option based on their financial needs. When comparing […]

Chit Fund vs Bank Loan – Which Is Better in Kerala? Read More »